EAB Group – Where we go Beyond Insurance

Providing insurance solutions with honest expertise in Green Brook, NJ, Boulder, CO and throughout the United States.

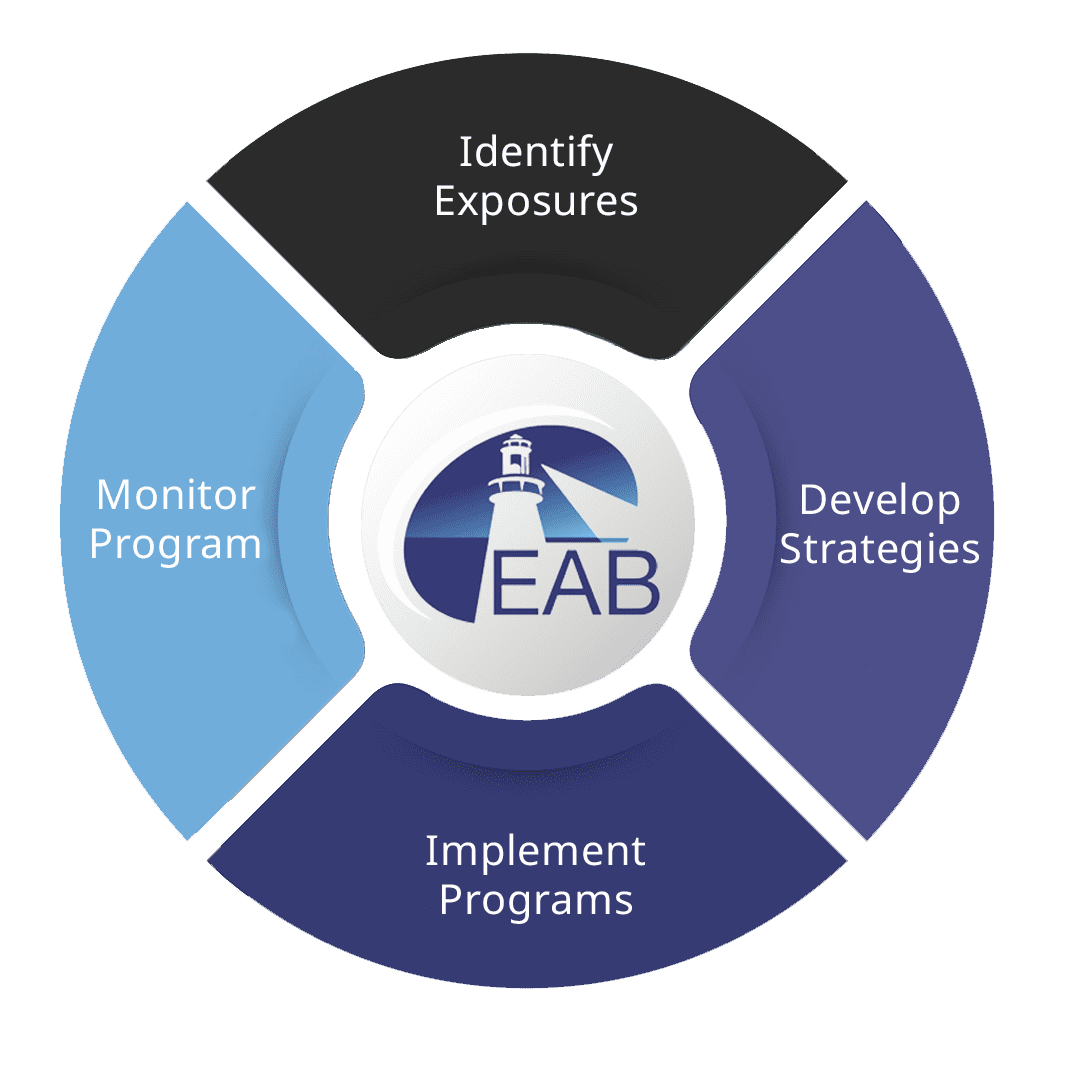

EAB 212˚ Beyond Insurance®

is a four-step process used by EAB Group to identify, understand, implement and monitor risk management strategies for you and your business. Here we briefly examine those four steps:

Step One

Identify

Exposure

Step Two

Develop

Strategies

Step Three

Implement

Program

Step Four

Monitor

Program

Insurance headquartered in Green Brook, NJ, providing insurance solutions throughout the United States

EAB Group offers personal insurance, business insurance and employee benefits.

Specialized Insurance Solutions

EAB Group offers comprehensive insurance solutions.

In a small room on the first floor of their private home in Green Brook, New Jersey, Ed and Eleanor “Ellie” Boniakowski started EA Boniakowski Insurance Services in 1950, with the humble philosophy that if your treat people right and do the right thing, success will follow.

Ed and Ellie recognized the increasing demand for reputable insurance services and forged major partnerships with several top insurance companies to create an agency their customers know they can trust. What started out as a two-person, husband-and-wife operation has since grown into a firm of 50+ employees, licensed in 25 states.

Today EAB Group operates out of a 5,000-square-foot corporate office in Green Brook, NJ – with a second office in Martinsville and our Western Division located in Colorado. The company still embrace their parents’ philosophy of providing real, honest expertise and getting the job done right the first time.

At EAB Group, we put our clients first and work to ensure their complete satisfaction. We take the time to understand our clients’ needs, and we value our ability to offer them the right products at the best prices.

We also believe just as strongly in giving back to the community. EAB Group takes pride in providing financial and volunteer support to more than 25 local nonprofit organizations that provide essential services to the community.

EAB Group continues to grow using the Beyond Insurance™ process, helping clients recognize potential gaps in coverage and reduce drivers of insurance costs. We go the extra degree to ensure our clients are completely satisfied.

You can be held responsible if you significantly damage another vehicle and/or property. Do you have enough coverage to protect yourself from the risk?

Your standard auto policy limit could easily be exhausted if you are found to be at fault. An umbrella or excess liability policy provides an extra layer of protection once your standard liability limits are exhausted. It’s a cost-effective way to ensure the peace of mind you deserve.

It’s easy to get distracted while driving. All it takes is an incoming text message, a fussy baby, or changing the radio station and your eyes are off the road long enough to crash into a pedestrian, bicycle, or another vehicle. As an owner/operator of the vehicle, you may be held financially responsible for any bodily injuries caused as a result of the accident.

An umbrella or excess liability policy helps extend your coverage to better protect you against these significant costs. It’s the ideal coverage to provide peace of mind, even when the unthinkable happens.

You invite guests over for a pool party and one of your guests dives into the shallow end of the pool and is permanently injured. They hire a lawyer to represent them and after a long legal battle, you and your family are left financially responsible for their injuries. Do you have enough money in savings to cover your legal responsibilities as well as the legal defense costs?

An umbrella or excess liability policy increases your personal liability limits by adding protection over and above your current auto, boat, or homeowners policies - providing real financial value, as well as priceless peace of mind. Excess liability insurance is available either by an endorsement to your homeowners policy or available as separate coverage.

Accidents can happen to anyone at any time, even those who have been out on the water for years. Personal watercraft insurance is a necessity, but sometimes the limit these policies provide isn't enough.

Your standard watercraft policy limit could easily be exhausted if you are found to be at fault for property damage or personal injury. An umbrella or excess liability policy can extend those limits, providing you an additional layer of financial protection.

There’s more to insurance than the price of the policy.

Explore our interactive graphics and learn about your unique risks and the related insurance solutions.